Mike Maples offers rules of thumb for entrepreneurs who want to build successful startups in his book “Pattern Breakers.”

Mike Maples on Pattern Breakers

Mike Maples is an early-stage venture investor and cofounder of Floodgate Fund with Anne Miura Ko. Floodgate positions itself as “Your First True Believers, backing extraordinary founders at pre-seed and seed” and “Co-Conspirators, Not Just Investors.” In “Pattern Breakers,” Maples reflects on the successful entrepreneurs he has invested in and worked with. He derives rules of thumb for entrepreneurs to identify business ideas worth pursuing and fine-tune them based on discussions with prospects and customers.

Mike Maples is an early-stage venture investor and cofounder of Floodgate Fund with Anne Miura Ko. Floodgate positions itself as “Your First True Believers, backing extraordinary founders at pre-seed and seed” and “Co-Conspirators, Not Just Investors.” In “Pattern Breakers,” Maples reflects on the successful entrepreneurs he has invested in and worked with. He derives rules of thumb for entrepreneurs to identify business ideas worth pursuing and fine-tune them based on discussions with prospects and customers.

“Unlike traditional investing, seed investing often involves backing just a couple of founders with an idea or possibly an early prototype with virtually no customers or historical financial information. […] Investing into a start-up isn’t like investing on Wall Street, where you can buy or sell at any time. Once we invest in an early-stage company, we stick with it until it is acquired by a larger company or it goes public on a stock exchange. Each investment journey can take several years, and there’s no off-ramp in the interim. […] I pride myself on being more than just a financier. I’m a co-conspirator with ambitious founders in their rebellions against the status quo.”

Mike Maples in “Pattern Breakers“

Startups Must Change the Rules Against Incumbents

“Business is never a fair fight. The default is an unfair fight where the status quo confers an advantage for the incumbent corporate players. It becomes an unfair fight in favor of the start-up when the start-up can change the rules. Unfortunately, most founders are more inclined to build within the current rules, so they never break the pattern. […]

Founders don’t create outlier start-ups by mastering established recipes or best practices. Instead, they embrace pattern-breaking as a core part of their job description and start-up journey. Being extraordinarily different is a key aspect of the breakthrough founder’s job description. It’s a different type of mindset, one that demands a talent for pattern breaking, an aptitude for breaking the mold. […]

Start-ups thrive by making rapid, massive strides in value creation, often by disrupting the norm. Instead of outperforming competitors, they redefine the game by introducing entirely new rules based on their unique insights. These insights leverage inflections to deliver transformative changes.”

Mike Maples in “Pattern Breakers“

This is the heart of Maples “pattern breaker” message. It’s the same insight you will find in Clayton Christensen’s “The Innovator’s Dilemma” and Kim and Mauborgne’s “Blue Ocean Strategy.” A startup cannot compete on the same terms using the same formula as an established competitor. It’s hard to see the “negative space” of a new opportunity where no current alternative provides a new mix of functionality or features that turn out to be desirable to at least a niche market. Easy to say, hard to do.

Inflection Points, Insights, and Ideas

Maples uses three words in a somewhat unique way to develop his model (bold added)

- “An inflection is an external event with the potential to significantly alter how people think, feel, and act. […] All things being equal, it’s better to identify the most powerful inflections you can. It’s also good if you can identify multiple inflections that might reinforce each other with their powers.”

- An insight is a non-obvious truth about how one or more inflections can be harnessed to radically change human capacities and behaviors.

- An idea is an attempt to conceive of some specific product or service, based on insights.

In “”Innovation and Entrepreneurship” Peter Drucker advises, Innovation requires us to systematically identify changes that have already occurred but whose full effects have not yet been felt, and then to look at them as opportunities. It also requires existing companies to abandon rather than defend yesterday.” An inflection is “a change that has already occurred.” It’s an event that can point you to further possibilities or potentials.

Because Maples is writing for startups he neglects two aspects of inflections that large companies that leverage:

- A minor inflection that enables small improvements. Incumbents can combine a sequence of these to compound and extend an existing product family that lowers or even neutralizes the incremental benefit of a startup product that requires a larger change in practice. Most inflections do not enable a startup to overcome this ongoing evolution.

- A private event in an R&D lab point to new possibilities–although it will still have to compete against a large firm’s existing product if it obsoletes it instead of extending or complementing it.

The potential of many events can be overlooked for years. In Nicholas Nassim Taleb in “AntiFragile” observes, “Implementation does not necessarily proceed from invention. It too requires luck and circumstances, and the wisdom to realize what you have on your hands. […] The Half-Invented. For there is a category of things that we can call half-invented, and taking the half-invented into the invented is often the real breakthrough.” Maples uses William Gibson’s observation, “the future is already here, it’s just not evenly distributed,” to make a similar point.

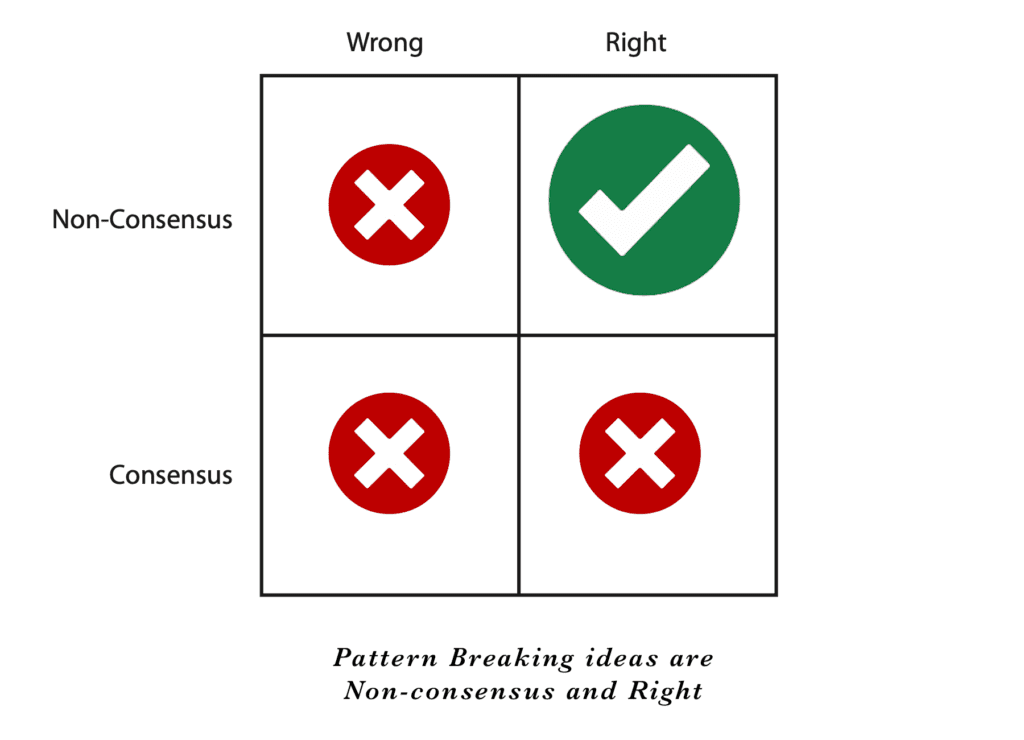

An Insight Is Non-Consensus (Non-Obvious) and Correct

In “Zero to One.” Peter Thiel defines a secret as “an important truth very few people agree with you on.” This definition is different perspective on what Maples means by insight. Another way to approach it is to realize that entrepreneurs exploit errors in conventional wisdom. In a 2001 interview with Business Week, Larry Ellison said, “I have always had difficulty with conventional wisdom. So teachers would say certain things–and I wouldn’t necessarily believe what they had to say. Just because they said it, and they were experts, and they were in authority did not automatically mean they were right. It created problems for me, but when you go out into the real world, it’s when you find errors in conventional wisdom–when everyone says A is true, and A is not true–that you gain your competitive advantage.”

The 2×2 matrix to the right is the payoff for a startup. It’s important to realize that the payoff matrices for incumbent vendors and customers are quite different.

The 2×2 matrix to the right is the payoff for a startup. It’s important to realize that the payoff matrices for incumbent vendors and customers are quite different.

An incumbent is unaffected if they rely on a correct insight that aligns with common wisdom: they continue to leverage their existing position and market power. They can survive executing according to the consensus view that proved wrong–unless another competitor is willing to depart from the consensus and finds a better approach. What gets product managers, business unit managers, and CEOs fired is betting against the consensus and being wrong, which makes it hard for most established firms to “leave the herd.”

Customers, especially large customers, face the same payoff matrix as established suppliers. If they invest, or continue to invest, in a consensus paradigm that is correct, they will continue to thrive. They are also likely to survive, at least for a while, if they stick with a consensus that proves wrong: they will be supported, at least for a while. A previously successful product can take a long time to die, and living on the “trailing edge of technology” is often cheaper in the short term. Individual managers at a customer are unlikely to be fired if they stick with the consensus; they are more at risk when they depart from the consensus and turn out to be wrong.

Startups need to find early customers who are willing to end up in the “non-consensus / wrong” box. This can take several forms but almost always involves a sequence of escalating “bets” or evaluation steps that are “safe to fail.” Founders must have an engagement approach that provides proof early by starting small and escalating the stakes as both sides gain confidence in a positive outcome. Successful early adopters at customer companies tend to be well respected and able to survive small failures and small setbacks. They explore your capabilities carefully and cautiously and you need to anticipate their need for proof and be willing to work form data they provide to deliver incremental results quickly.

“Early Customers Need to be Believers: These first believers are your external co-conspirators. Like your internal ones, they are kindred spirits attracted by belief, not utility, to the future you inhabit.”

Mike Maples in “Pattern Breakers“

My problem with the “believer” is that it’s true but misleading, at least for B2B markets.. Early adopters are often in a lot of pain in their current situation and willing to invest effort and take small risks to see if you can help. Successful early adopters will have two or three backups ready if your product does not work and are often exploring multiple options in parallel. You have to demonstrate positive results consistently, be candid about your product’s shortcomings, and consistently act in ways that earns trust.

An Implementation Prototype is not the MVP but a tool to uncover surprises

Implementation prototype: A focused deliverable that helps you engage potential early believers to identify:

- What is the most important benefit?

- Which customers will view it as a “must have?”

An implementation prototype is not an MVP. People sometimes confuse an implementation prototype with a minimum viable product (MVP), but the two are different. An MVP is the most stripped-down version of a product that can still be released and used by early adopters. An implementation prototype is a step before creating your product. It seeks to validate whether your idea can become a product that specific customers must have once they fully grasp and connect with your concept. […]

Prospects consume a description of your MVP before they decide to learn more about it, much less invest effort in evaluating it. So the first thing you must discover is how to talk about how it can help them. The second thing is a problem, need, or challenge they have that makes them interested in the benefit. Finally, it’s essential you learn the questions that allow you to diagnose whether a prospect has a situation you can assist them with. These three items are all part of the “implementation prototype.” Without them, you risk turning your MVP demos and customer evaluations into IQ tests: “Are you smart enough to figure out how you can use this product to improve your business?”

Even if your insight is accurate, you’re navigating a highly unpredictable terrain when interacting with early customers. Pitching an implementation prototype to potential customers is akin to laying out a map of what you believe the future holds. Since you are traveling through unexplored territory, you should expect course corrections along the way. That’s why not only should you expect surprises; you should savor them. I’ve seen founders struggle with surprises. Rather than venturing into the unknown with an eye toward noticing the unexpected, they approach early customers with a confirmation bias, aiming to validate their established hypotheses. It’s not enlightenment they’re primarily after, but affirmation. […]

When founders overemphasize validation, they unintentionally shut the door to the profound lessons these interactions can offer. The essence of an implementation prototype is its ability to act as a conduit for unexpected revelations, allowing founders to refine and improve their concept based on these surprising discoveries. If your insight is correct, you should be able to find specific people who are desperate for you to build a product implementing that insight. But as you explore whether this is indeed the case, there are two important variables for you to consider:

- Is this the best way to implement my insight?

- Am I talking to the right people?

At the beginning of your explorations, it’s OK that most people you talk to are not interested. Don’t transition into “objection handling” mode; your goal should be to ensure they understand what your MVP offers and then engage actively with those who are strongly interested. Adjust your search criteria for who you believe should be most interested based on what you learn. A few instances of strong interest are better than many who are mildly interested. Paradoxically, a strong negative reaction is also very useful if accompanied by specifics; it normally indicates that they are in a lot of pain and disappointed that your MVP does not seem like it will help. A consistent lack of interest should encourage you to reconsider your fundamental insight.

Strengths and Predilections of Large Established Incumbents

A corporation’s success can introduce several different types of bias against achieving breakthroughs.

- A bias toward existing value creation: Established businesses build value by focusing on their core operations. They optimize and leverage existing advantages to deter new entrants and dominate competitors.

- A bias against risk-taking: Established businesses equate risk with uncertainty and aim to avoid it.

- A bias toward punishing failure: In established businesses,executives often shy away from risky projects due to the career-threatening nature of failure.

- A bias toward agreeableness: In established businesses, leaders prioritize stability and alignment, traits that are rewarded with career advancement. Their focus is on disciplined execution within existing frameworks.

- A bias against new approaches.

- A bias toward corporate metrics: Established businesses rely on traditional financial metrics like return on net assets, earnings per share, return on invested capital, and internal rate of return to guide funding and measure success.

Mike Maples in “Pattern Breakers“

I thought this was a very useful list for two reasons: it gives startups a good idea how established firms will choose to compete with them and it give a preview of the likely evolution of the startup’s culture and values.

Related Blog Posts

- Entrepreneurs Exploit Errors in Conventional Wisdom

- Lighting the Way for Your Competitors

- Peter Thiel’s Zero to One devotes Chapter 8 to “Secrets”

- Howard Marks: “Dare To Be Great”

- What Was Heroic Must Become Routine: Your Post Launch Growth Plan

Slides from Wed-Dec-18 Book Club discussion: Book Club_ Mike Maples _Pattern Breakers_ Dec-18-2024

“Non-Consensus and Right” Image sourced from https://patternbreakers.substack.com/p/pattern-breaking-startup-ideas by Mike Maples, used with attribution.

This post was republished on LinkedIn at https://www.linkedin.com/pulse/key-takeaways-from-pattern-breakers-sean-murphy-4539c