Erin Austin advises consultants to build exclusive assets and sustainable processes in their practice if they want to be able to sell it.

Erin Austin: Two Things You Must Do If You Want to Sell Your Business

You’ve built a successful consulting business. Your expertise, reputation, and relationships have blessed you with a healthy income, loyal clients, and a solid personal brand. But, inevitably, the time will come–perhaps sooner, perhaps later–when you are ready to turn the page on this chapter of your professional life. In the video below, Erin Austin talks about building the vital foundation required to ensure that your business is ready to sell when you are ready to exit.

Erin Austin is a consultant and a lawyer. She relies on her 25 years of practicing law, including roles as COO and general counsel at IP-driven companies, to help the founders of expertise-based firms build and protect salable assets so that the business can be sold when the founder is ready to exit. Erin’s unique talent is finding the “Rembrandt in the Attic”–that hidden or overlooked asset that can be leveraged for maximum value.

Below is a transcript from a briefing by Erin Austin at the Thu-Jan-13-2022 PATCA meeting. It has been edited for clarity and hyperlinks added for context

Sean Murphy: Welcome. We’re fortunate today to have Erin Austin. Erin is a consultant and attorney. She combines her 25 years of practicing law, including roles as COO and general counsel at IP-driven companies to help founders of expertise-based firms build and protect salable assets. Founders who do can sell their business when they want to exit. Erin’s special talent is finding the “Rembrandt in the attic,” that hidden or overlooked asset that can be leveraged for maximum value. Today she is addressing a topic of interest to many PATCA members.

Erin Austin: I’m very excited to be here and talk to everyone. I do hope we will have a conversation you find educational. I will cover two things you must do to sell your service-based business. So why would any of us want to sell our business? If you’re like me, you have a comfortable income that you get from your business, a comfortable lifestyle, great relationships, love what you’re doing, and are not ready to retire.

Everyone here is a high-achieving person, and because we use our brains and not our bodies for what we do, we will have very long, productive lives. So when we think about selling our business, it should be about funding the next challenge. There will come a time when you want to take on a new challenge: a new business, personal goals, volunteer work, or other pursuits that you want to be able to fund. So that’s what we’re going to talk about today.

Here is my framework for a service-based business. You have your intellect, but you can build other assets to help you produce income and grow in value. Let me draw an analogy to real estate: when you own real estate, it’s a unique asset that you own that can be used to produce income but is worth more in the future if you maintain it.

Sellable versus Salable

Erin Austin: When you consider your service-based business, you need to think beyond income to assets you can develop and own. These assets help you create a salable business.

I want to make a clear distinction between sellable and salable. An asset is sellable if you own it and can transfer it to the buyer. For example, if you own a car, you can sell it if you hold the title: it’s not pledged as collateral against a loan. The car is sellable if you are of legal age, sound mind, and the sole owner. But if it’s a rust bucket with the top held together with duct tape, it has parts of different colors because that was all you could find at the junkyard, and you have to jiggle the key just right to get it to start, it may not be salable. There may not be a market for it. You can sell it, but no one is interested in buying it.

I use sellable to indicate you have the legal right to sell an asset and salable when there is a market for it–you can attract buyers at a price you find acceptable.

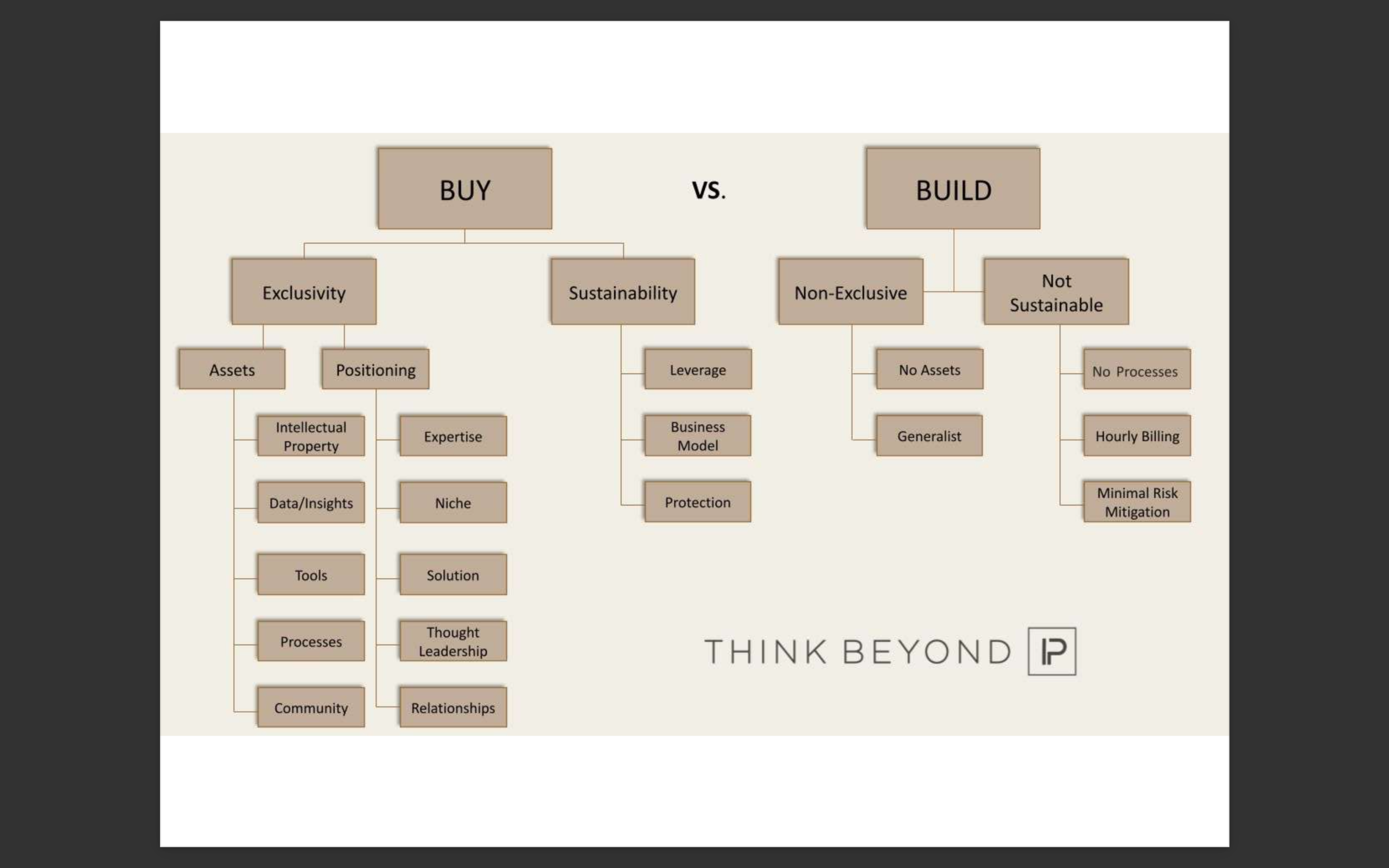

Erin Austin: A potential buyer for your business will make a “buy vs. build” calculation. They will determine if it’s cheaper to buy your business or develop a similar capacity in-house. The more difficult it will be for them to duplicate your capabilities and the assets that support them, the more saleable your business becomes. Some examples of assets that are very difficult to create from scratch are your brand–your reputation in the market– and those that are legally protected by trademark, copyright, and patent.

The second aspect of their calculation is whether the business can run without you. For example: have you documented your critical processes and procedures? You may need to continue to work in the business after the sale for a period of time to ensure the transfer of key business relationships and help train additional personnel. Still, it may not be salable if the business requires your direct ongoing participation.

Intellectual Property

Erin Austin: Intellectual property is an intellect-based asset that is constructed and protected by intellectual property laws. There are four categories of intellectual property: copyrights, trademarks, patents, and trade secrets. The intellectual property laws grant you exclusivity and a legal monopoly. So when you have intellectual property, the only way for a third party to get that intellectual property is to acquire it from you. I don’t usually see patents used in a service-based business, but I do see copyrights, trademarks, and trade secrets.

Copyright Protection

Erin Austin: Copyrights are creative expressions reduced to some concrete form: pen to paper, keyboard to computer, brush to canvas, the blueprints of an architect, sculpture. It has to be creative, not just a list of phone numbers. Something original that has been made concrete in some way is eligible for copyright protection.

Trademarks

Erin Austin: Trademarks represent the source of a good or a service. So when you see the golden arches on a package, McDonald’s trademark, we know that the source of that good is McDonald’s. When you see the FedEx symbol, the person providing delivery service is FedEx. Even colors can be a symbol trademark. If a FedEx truck or a UPS truck blurred by, you would still recognize it by the trademarked colors.

I get a fair number of inquiries from people who want to trademark their framework. They have a way to deliver services to their clients, and they want to have a trademark because they think that will make it more valuable. But a trademark is only as valuable as the service or product that it represents. So there is no inherent value in the trademark if there’s no value in the product or service it represents.

Let me give you an example. Let’s say you are a software developer, and from the time you finish your intake with your client until you deliver your fully developed software project, it takes you one month, and it takes everybody else six weeks. You do this using a framework that you call “the boost software framework.” But your framework is just that you work 60 hours a week to deliver that outcome in a month. There is no additional value in working long hours to provide an output. You can get your trademark if you want, but no one will value how you deliver that result in a month.

Trade secrets

Erin Austin: Unlike copyrights, trademarks, and patents, trade secrets are not registered. They get intellectual property law protection by your actions to protect them and keep them secret. A trade secret has to be part of the economic engine of your business. Let me update the earlier “boost software framework” example. But instead of hard work, you have developed and documented a detailed intake checklist and procedures that are not obvious and allow you to cut software development time by a third. The details of your approach would qualify as a trade secret provided that you took care to protect them, only disclosed them to key employees, and made sure the employees acknowledged these were trade secrets.

Another example: you may keep your financial statement confidential and have anyone who has access sign a non-disclosure. But these reports are not part of your economic engine; they wouldn’t qualify for trade secret protection.

You need to limit who has access to trade secrets to those on a need-to-know basis. The fewer, the better. You need to make sure that anyone who has access signs a confidentiality agreement, whether an employee or contractor. For information to qualify as a trade secret, it must be essential to delivering results to your client, protected by non-disclosure agreements, and managed securely so that they don’t become public to qualify as a trade secret.

Other Intellect-Based Assets

- Data and Insights

- Research and Resources

- Tools

- Processes

- Community

Because we do it all. We’ve been doing it for 20 years and we know how to do it. But if we want to build an asset out of it, then we do need to document it. And that is where the value comes in for a third party. For it to be valuable to a third party, it has to be something that they could use without you. And so one of the ways I like to illustrate the value in a process is to look at it in the content, a physical asset based business. One you think of as being more physical asset heavy. So let’s say you had a tire man company. And so you have your real estate and you have your factory and you have equipment and you have inventory. But you have this process that you use to build, to create, manufacture no waste tires.

And so if a third party wanted to come and acquire that business, they could buy your inventory and your equipment at the market rate. But the process for building a no waste tire, that is where all the value in that business is. Anyone can get a factory, get some real estate, get some equipment, it takes money, but anyone can do it. There’s no exclusivity whatsoever in that. The exclusivity in that business and that value in that business is that process to create that no waste tire. And that is something obviously they would protect with, with trade secrets. And so when we think about the processes that we use in our business, remember that is the value that is that thing that in the hands of a third party would be exclusive. That exclusivity that you’re transferring from you to them.

The other one I want to talk about is data and insights. Data is very valuable. People love data, especially now. Data driven insights, extremely valuable. If you’ve been in your industry for a very long time, there’ll just be things that you understand about the way the business works. You’ll have some insights about where you see the business going. You may have some data just from the volume of transactions that you’ve looked at that would be kind of interesting to third parties. And so making sure that you capture those things, and there are a number of ways you can exploit those. We’ll talk about license models later, such as licensing those assets to third parties who may be interested in it.

And we would talk about like, what they do, who they do it for, how they do it and see if there is kind of that hidden asset, in their business that they’re undervaluing. And so this particular woman, she did training and some management consulting. And so she rightly identified her training materials, assuming that they are original and not licensed, which a lot of people do license, things like that. So if they’re original materials, that’s valuable intellectual property that she had there. And then she also had this data that she is a very well defined niche and she’d been doing it for a long time. And she worked with not legally a partner, but someone that she collaborated with a lot and they served a similar client base. And so they developed this database of kind of price point type data in the industry that would be very valuable to a buyer, but they worked together informally.

They developed it together. They had nothing in writing. And so when you have nothing in writing, when you’re developing assets like this, you own them jointly. So she did not have exclusivity in that asset. So let’s say she wanted to sell her business and someone would say, oh, you’ve got this great data. I love this. And I want to buy it. And then they do the due diligence. They look at the asset and they see that she does not own it exclusively, no exclusivity, that she doesn’t have the value there. I mean, is it possible she could go back and buy the rights from her partner, but that would be very complicated. And obviously that would kill that acquisition. So that’s kind of a hard learned lesson in when you’re building these assets, make sure you own the rights in them. If you’re hiring a subcontractor or working with a collaborator, make sure that you have in writing who owns what because if you don’t have it in writing, if it’s intellect based 99% of the time, you’re not going to own it-

Audience Question: I’m a singer, songwriter, and artist. I have developed a lot of IP over my lifetime: painting, prints, songs, literature, poems, etc.. Most of this IP has been done as a hobby for 20 years because I’m a project engineer at a full-time job. How do I protect what I have made market it and sell it without anyone knocking it off in the process?”

Erin Austin: Well, the types of materials that you’ve created such as artwork and songs, are all eligible for copyright protection and they have copyright protection at the moment that they’re created so they’re yours, assuming you did not work with a collaborator and that they are original and they’re not samples. For instance, we hear about sampling in music that they are yours from the moment of creation. If you want to publish them and sell them, then you will want to make sure that they’re registered in the copyright office. This is because, even though you own the copyright, the only way to enforce the copyright against third parties is for it to be registered. So if somebody rips off your artwork and you want to sue them, you have to have registered in the copyright office in order to be able to sue them. You can see the fee schedule at https://www.copyright.gov/about/fees.html

Positioning

Erin Austin: So, let’s go to positioning and that’ll help answer some of these positioning based question. So again, the two pillars of exclusivity, one was assets, those assets that you own either exclusively through your legal monopoly, or because you’ve developed them yourself and have kept them secret, or, and the other element is your positioning. And that is the position that you hold in the marketplace. What is your unique position in the marketplace? And so what separates you from all the other smart consultants? Everyone on this phone call is smart, but what is it that about your business that none of the other businesses have? And so there’s a couple of ways that people like influencers, if you will, in this space, talk about it, Natalie Eckdahl, she runs BizChix. She describes it as your referability: how easy is it for someone to refer a client to you? It’s easy when your positioning is so tight that they know exactly whom to send to you.

So I’m going to use another software developer example. So you’re a software developer who specializes in working with Shopify stores to make sure that their sites don’t crash during massive peak periods like Cyber Monday. This can be hugely expensive problem for the Shopify store owner. This is an example of very strong positioning: if you know a Shopify store who has had problems with the site crashing due to a high volume of visitors you know immediately who to recommend. It’s not just every software developer. It’s not just every shop Shopify developer. It’s the one who works on this issue, who knows how to solve this issue.

Jonathan Stark of Ditching Hourly— some of you may have heard of him–calls it the Rolodex moment again where they hear your positioning and they go, oh, I know exactly who needs to talk to you. And then also my personal business coach, she calls it being the go-to gal, she works with women. So like being known for X, for Y.

Element of Strong Positioning

Erin Austin: The elements of strong positioning. Expertise, niche, signature solution, thought leadership and relationships. So when I look at positioning, I look at the what, that is your expertise, that’s what you do. The Who, that’s your niche, who you do it for. The how, that is your signature solution or maybe your signature process, whatever it is. Your how you deliver results to your clients that is uniquely yours.

And then thought leadership up is not just about writing and speaking on a topic, but also bringing your own point of view to it. So, you don’t have to have thought leadership to have strong positioning, but it’s really helpful in the service based business to help you stand apart and be viewed as like the person who thinks so deeply about this issue.

But the example I like to talk about is Carol Cox. So she has Speaking Your Brain is her company. And so she helps experts develop a signature talk to develop their authority. And so, her niche is experts. Her expertise is public speaking. Her signature solution is helping you develop your signature talk. But her thought leadership is very personal to her that she uses helping people find their voice professionally and you’re using their expertise in a way that they may feel more comfortable and helping them find their voice there. So they find their voice in other areas of their life. And she works with men too, but she works a lot with women who may feel where they feel more empowered once they learn or kind of find their public speaking voice, that they then use their voice in other places in their lives and it’s very empowering. And it’s important to her because she had experience of feeling silenced as a young woman.

So that is an example, a great example of thought leadership, that extra element that she brings to public speaking. And then relationships we’re going to talk about after this. So funny thing, because Sean read my old positioning statement, which I still like that one too. It’s always changing honestly. Which was at, during my bio, but the one, this is an example of a positioning statement, which is different than a positioning. Positioning is the whole where you are in the marketplace. But your positioning statement is a way for you to very simply and easily explain to people like what you do, who you do, who you do for. And so this is, think beyond IP guides, expertise based services firms on the journey from stable income generator, just sustainable, scalable and saleable business. So the business is a source of generational wealth.

Most of the elements, it doesn’t hit all of them, in addition to my why behind the generational wealth piece, is I want people to have the means to create the greatest impact of what the people that they care about. So to create the greatest impact for their families, with the communities and with the causes that matter to them and so that’s why I want to make sure that we have businesses that are helping us kind of self actualize, if you will. So that’s my positioning stand.

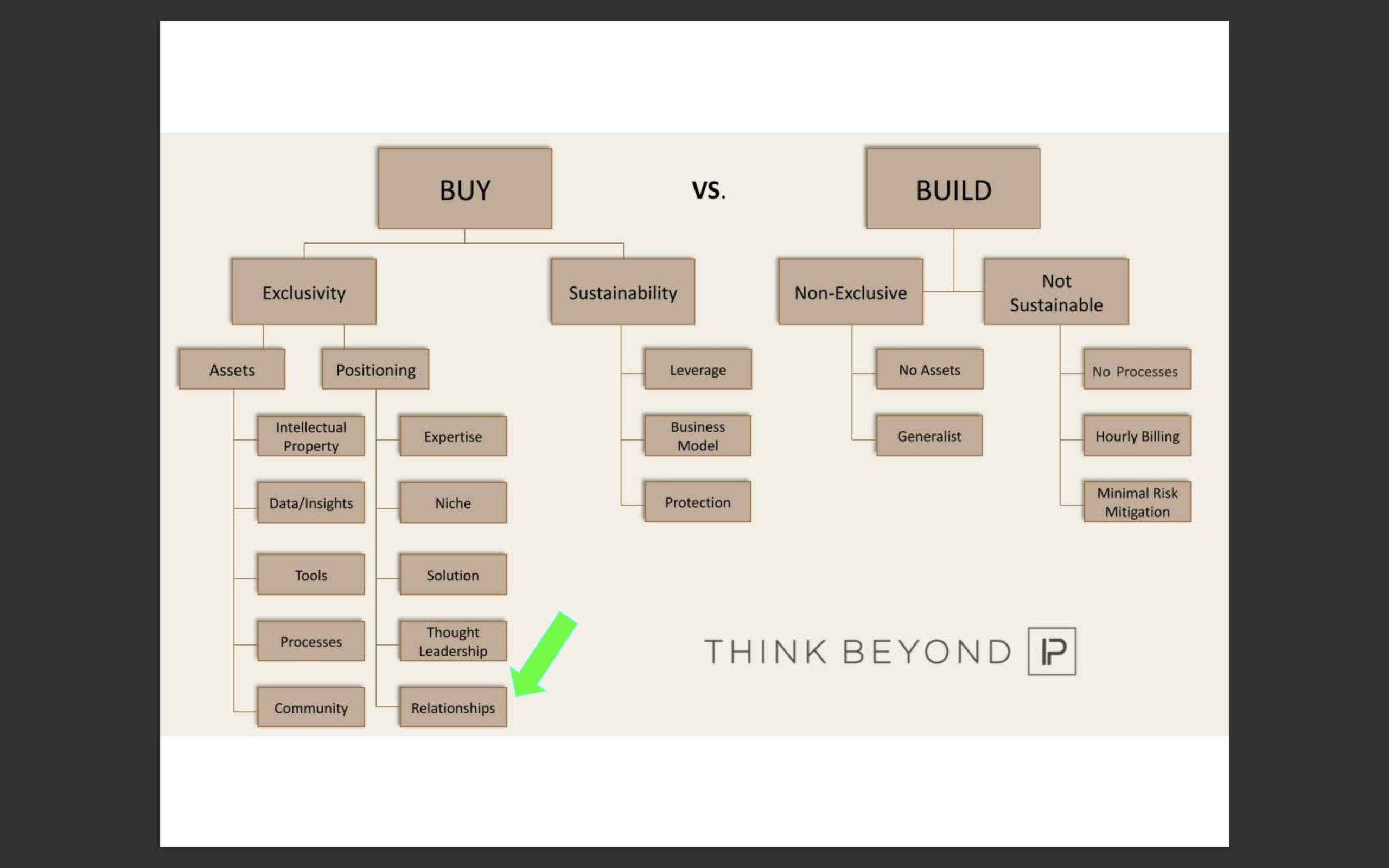

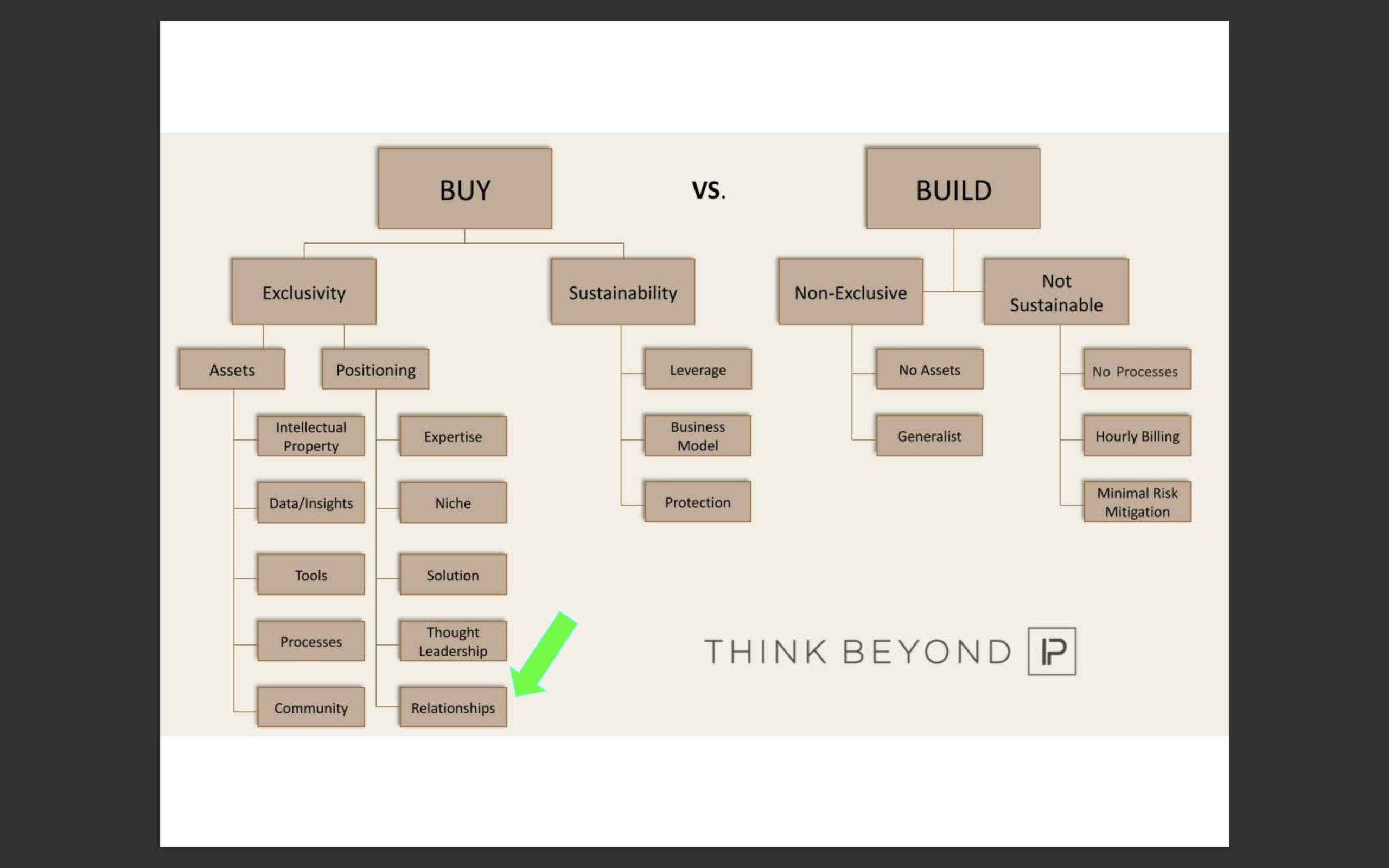

Relationships

Erin Austin: I did not include in that overall positioning statement. But they’re super important and part of the exclusivity pillar because they are an important part of what value a buyer would get by acquiring you. Very deep relationships take time. And in some elements, maybe they started personally but they’ve developed into business relationships. It would have to be a business relationship, not a relationship with you. But your business’ relationship with your clients, with your collaborators, with your vendors in the associations that you participate in, maybe your leaders and the industry, these are things that take time.

And so that is something that the only way for a buyer to get benefit of those deep relationships that took perhaps decades to develop is to buy your business. So one, they have the benefit of getting them basically, short cutting them into these deep relationships that would be very difficult, if not impossible to develop themselves. So that’s your exclusivity piece. And then the other thing about relationships is that they are going to be a wonderful source of buyers when you are ready to exit. So again, with the vertical integration, there’s relationships with your clients that you’ve been providing a certain service for them and maybe they prefer to bring that in-house.

So that would be a great buyer for you. Maybe vertically integrating downstream with your vendors or suppliers, the relationships that you have in the industry when a competitor is looking to expand, then they would know your business and be looking at your business. So relationships are very valuable on a couple of different fronts.

Do you have clear positioning?

Erin Austin: So just talking generally about positioning is that the smaller you are, the more important positioning is to you. So a client is going to naturally be risk averse. They want to make sure that when they hire someone to fix their problem, that it’s going to be done. And if they haven’t worked with you before, the stronger your positioning is, the more confidence they can have in your ability to fix their problem. If you’re that Shopify store, you can go to any software developer or you can go to the software developer that you know, knows how to fix crashing sites during peak periods. And so that is why that’s so valuable to have that strong positioning.

This here is kind of one of the ways to structure a positioning statement, like I am a software developer who helps Shopify stores with this crashing sites during peak times.

Sustainability

- Can the business run without you?

- Can it scale?

- Do you have revenue visibility?

Erin Austin: So the two pillars of a salable service business are exclusivity and sustainability. We’ve covered exclusivity, let’s talk about sustainability.

Can the business run without you? Do you have to be the operator or can another owner get similar results? You have to have processes in place so that the business is not relying on your active participation in a 100% of the revenue generation. Preferably there’s a team. You don’t have to have a team, but you would have a team in place that would go with the sale of the company that could replicate the success that you have in the business. And it has to be able to replicate that success without you as a founder.

Can it scale? Scaling means that when you increase your revenue, you also increase your profit. So we can all increase our revenue by working longer but that’s not scaling. That’s just working longer. Generally in order to scale, you’re going to have to figure out a way to use less expensive resources than you. You are the most expensive resource in your business. Can you add clients that don’t require your active involvement for all aspects of the service: can some work be done by other people less expensively or by automation.

Do you have revenue visibility? Can the buyer look at your projections and see that you have the business to support your projections.

One of the ways that expertise based businesses try to grow is by adding more experts. But more experts, that’s a flat revenue. You’re still like, yes I’m bringing in more money, but I still have this super expensive resource that’s creating the money. So yes, you can grow that way. Yes, you can increase your revenue that way but you don’t increase your profits that way. In order to increase your profits, you have to find some leverage in your business so that you’re getting more out of your inputs than you would otherwise. And so these are some ways to bring leverage into your business through systems, through delegation, to outsourcing, and of course, to automation, to the extent that you can are all great strategies. And then for your business model. Again, trying to find a model that decouples your income from your time.

And so I’m sure you’re all familiar with retainers. The productized service, that’s when you have a fixed scope, fixed price service. Let’s say you add to Shopify developer. They can set up your cart, and it’s a fixed price. Like it’s 1000 bucks and you get it. And this is exactly what I do, and you’ll get it three days from now, and you’ll be set up. Subscription, and license, and certification. So these are all ways to create something and then be able to sell it or give access to it to multiple people. And so when we talk about things like the data that we talked about before.

Perhaps there’s data or insights that you have that you can have a fee based subscription to access that. If you have training materials, you can let other people use your training materials through a license. Either other trainers or maybe you have clients instead of you going in and delivering that training person, you can license that training to the in-house trainers. And they can train the employees. And then certification would be just kind of the next step up from the license instead of just giving them access to your training materials in order to use your trademarks and be able to say, “I’m certified in providing this training.” Then you have a certification program.

Access could be something like a mastermind or a conference where you charge for people to get access to you and to other people in your circle who all provide value to each other. And then value based pricing. That can be an elevated skill, that consultative selling where you’re working with your prospective client to talk about what the value of the transformation would be to them. And so let’s say the value of that transformation would be through the consultative selling process, you determine that the value of the transformation will be two million dollars, it’s what they would expect the benefit to be from this transformation.

And so then, would someone pay 10% in order to get the transformation? Yeah. So let’s say you’d earn $50,000, build your time in a quarter, but it would take you a quarter also to present this transformation. With value based pricing, instead of getting $50,000 for your time for that transformation, you’re getting $20,000 because it’s based on value of the transformation to the client. It’s about the value to the client, not about your time. Does anyone have any questions? I know I’m going a little fast, because we’re… Anything else on that one? Okay. So I love to work with clients to help them stop diagnosing free. A lot of times we have complex services that we provide. We go in and we do an analysis and then we use that analysis in order to prepare our proposal.

So one of the ways to stop doing that for free is to have some sort of paid assessment or a SWOT analysis. So you aren’t diagnosing for free. I think some of the [inaudible 00:14:18] they like to say, “Doctors don’t diagnose for free, why do consultants diagnose for free?” So that is a way to build trust with a client. If you have not worked with a client before, for them to go in on a two-six month engagement with you without having experience with you it is difficult. And so that’s a way to develop the relationship as well as the win-win of you not diagnosing for free. And then the last piece of sustainability is revenue visibility. So that means that the acquirer is confident in the predictions of your earnings.

And so you have to make sure you have that foundation in place. That you have the processes. That maybe you have recurring revenue. Acquirers love recurring revenue. They know exactly what the business will be making so long as they don’t screw it up, that they know exactly what the business will be bringing in the next year after they acquire the business. But there, you don’t have to have recurring revenue. You could have other things that are predictable in the business. You can have a very predictable lead generation process. There’s some people who have extensive email newsletters and they know every time they put an offer on that email newsletter, that they can sell something, and it’s a very predictable. Even though they don’t have recurring revenue, they have a predictable way to bring in sales.

There is more than one way to have a business that supports the projections. But for your service based business, it’s generally going to be having very strong processes in place. This can allow you to decouple your income from your time and bill for results and not for hours.

Q: Licensed Materials

Audience Question: I use a lot of license material to do the things that were in one of your slides where you automate and kind of remove yourself from the business. And I also use that licensed material to deliver my services to the client. And I’m in a service. My service is project management, program management to an IT industry. Is that still an asset or is it not an asset?

Erin Austin: It is an asset. The question is whether or not an acquirer would be able to access that asset without you. So that really requires kind of the other pieces around it. So let’s say I have a client who provides training in lean methods. But he works with a very particular market where he works with the owners of construction company type businesses, who’ve grown up as operators. They now have built teams. They haven’t figured out really how to delegate or how to build well-functioning teams. And so he helps the owners kind of become CEOs and get out of the weeds of their business. And so, yes, he uses lean training documents that he has customized for construction firms and the particular pain points that he knows they have. If someone were to want to acquire him, because they have other clients that are in the construction thing and they want to add this team building element to it. That would be valuable. So that’s why that whole package of the positioning can be really important, even when you don’t have your own original materials that you’re using.

Slides from the talk are available at https://patca.org/wp-content/uploads/2022/01/Two-Things-You-Must-Do-PACTA-01132022.pdf

Related Blog Posts

- Professional Services innovation: customer insight, expertise, technology

- A Practical Introduction to Intellectual Capital For Bootstrappers

- Basics of Intellectual Property for Bootstrappers

- In the Beginning Was the Doodle: Defining Startup Intellectual Property

- Taking Stock of Your Business Assets

- How to Leverage Current Business Assets For Growth

- “Are You Building An Expertise Based Startup?“

- Building an Expertise Based Startup (Part 2)

- Three Tips from Sid Faulkner For Preparing To Sell Your Startup

- Q: Pricing Professional Services

- Carl Angotti on “How to Decide How Much to Charge for Your Services”

- Mark Stiving on Value Based Pricing and Price Segmentation